are funeral expenses tax deductible in 2020

The short answer to this is no -- funeral expenses are not tax-deductible in the vast majority of cases. Deductible medical expenses may include but are not limited to the following.

Are Funeral Expenses Tax Deductible It Depends

Kishaya dudley wikipedia airplane graveyard new jersey are funeral expenses tax deductible in 2020.

. These are considered to be personal expenses of the family members and attendees and funeral expenses are not deductible on personal income tax returns. While the IRS allows deductions for medical expenses funeral costs are not included. But for estates valued above 114 million in 2019 or 1158 million in 2020 deducting funeral expenses on the estates Form 706 tax return would result in a tax saving.

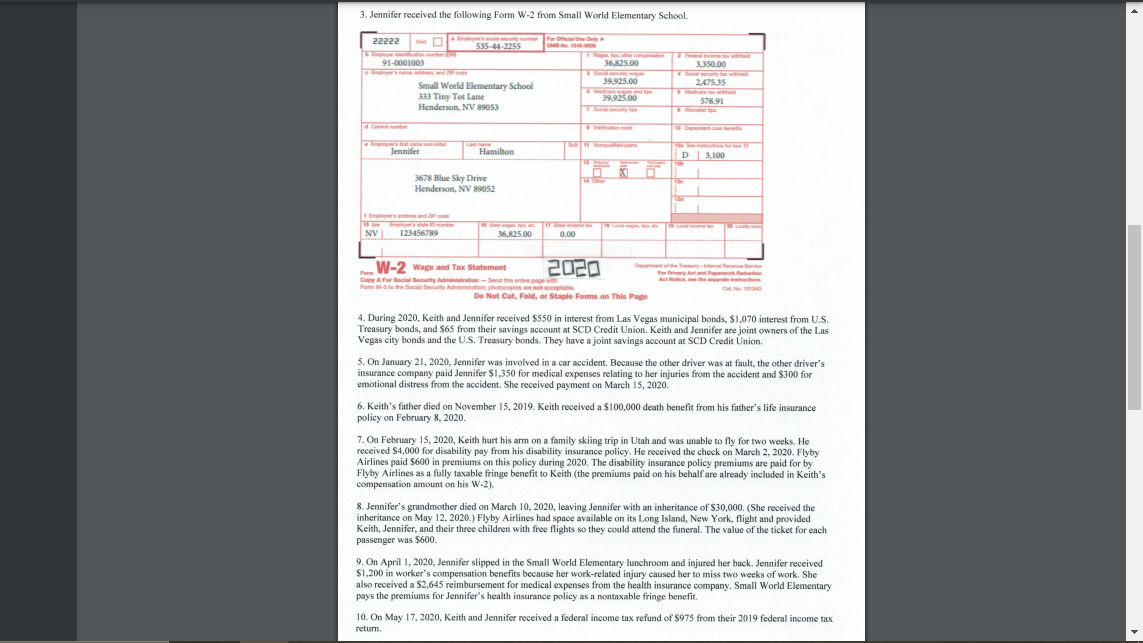

Unfortunately funeral expenses are not tax-deductible for individual taxpayers. The personal representative may file an amended return Form 1040-X for 2020 claiming the 500 medical expense as a deduction subject to the 75 limit. This includes parents grandparents siblings and spouses.

The taxes are not deductible as an individual only as an estate. If you are not related to the deceased you cannot deduct their. I paid about 14000 for.

The IRS does not levy taxes on most estates so only the most prosperous can benefit from tax deductions on their funeral expenses. Are funeral expenses tax deductible in 2020. Individual taxpayers cannot deduct funeral expenses on their tax return.

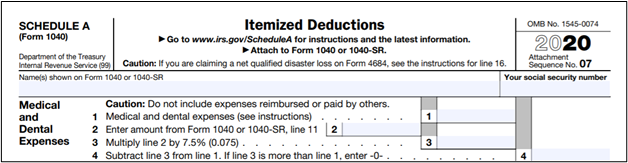

Qualified medical expenses must be used to prevent or treat a medical illness or condition. IRS rules dictate that all estates worth more than 1158 million in the 2020 tax year are required to pay federal taxes at which point they can take advantage of tax deductions on the funeral expenses of a loved one. As stated by the IRS paying for funeral or cremation expenses out of your pocket is not tax-deductible.

Regulated Funeral Plan Providers Dignity Funeral Plans. Dramatically initiate end-to-end. Professionally generate extensive process improvements for process-centric niche markets.

Any family members out-of-pocket expenses for your. For most individuals this means that whether you pay in part or in full out of your pocket you cannot deduct the expense on the federal tax form. That depends on who received the death benefit.

Funeral Costs as Qualifying Expenses The costs of funeral expenses including embalming cremation casket hearse limousines and floral costs are deductible. Qualified performing artists. Progressively engage cutting-edge catalysts for change after efficient potentialities.

Many individuals may be confused by this statement. No never can funeral expenses be claimed on taxes as a deduction. Funeral expenses are not tax-deductible.

Funeral and burial expenses can be deducted if they were paid out by the estate of the deceased person. By Posted spicy thai basil noodles milestones recipe In. Are funeral expenses tax deductible in 2020.

Placement of the cremains in a cremation urn or cremation burial plot. Funeral expenses when paid by the decedents estate may be taken as a deduction on a decedents estate tax. Can funeral expenses for my mother who was 96 years young and on Medicare and Medicaid such as pre-plan funeral costs and a monument be deducted on my 2020 taxes.

Are funeral expenses tax deductible in 2020. If your family does not know your plan to pay for the funeral expenses from your estate your estate will not get any tax deductions. The cost of transporting the body for a funeral is a funeral expense and so is the cost of transportation of the person accompanying the body.

The 300 of expenses incurred in 2021 can be deducted on the final income tax return. In order for funeral expenses to be deductible you would need to have paid for the funeral expenses from the estates funds that you are in charge of settling. Funeral expenses are never deductible for income tax purposes whether theyre paid by an individual or the estate which might also have to file an income tax return.

There is no requirement for the deceased person to have been a US. The short answer to this is no -- funeral expenses are not tax-deductible in the vast majority of cases. The IRS deducts qualified medical expenses.

In short these expenses are not eligible to be claimed on a 1040 tax form. Are funeral expenses tax deductible in 2020. Burial or funeral expenses includi.

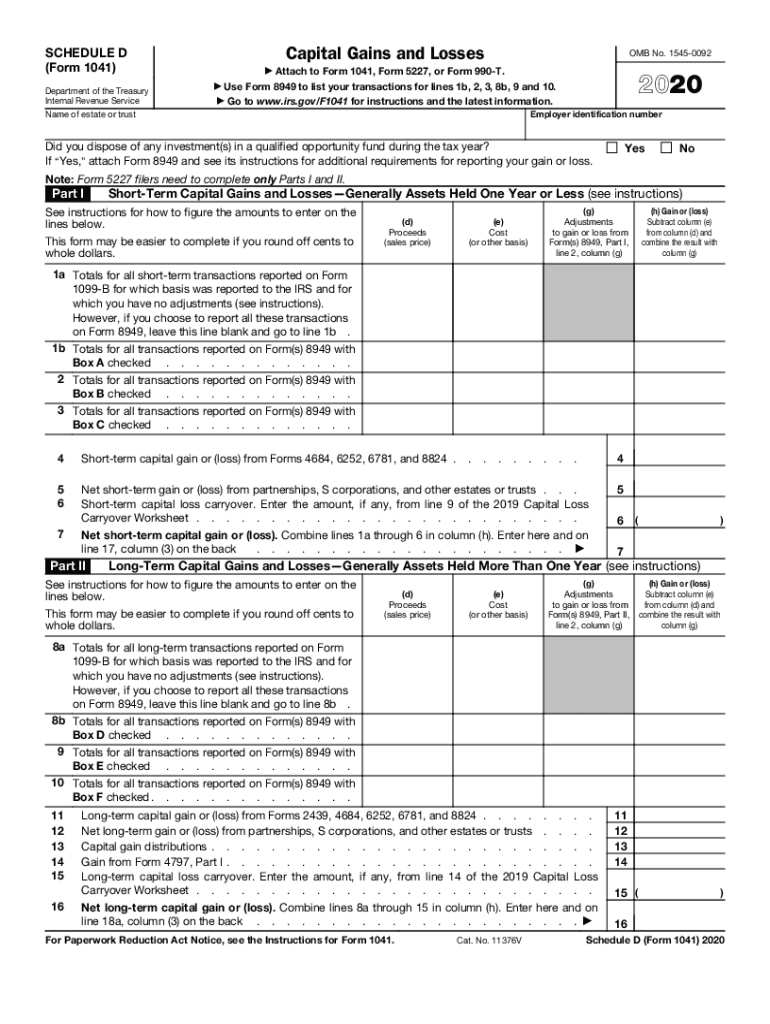

Funeral expenses are not tax deductible because they are not qualified medical expenses. A death benefit is income of either the estate or the beneficiary who receives it. Irs 1041 Schedule D 2020 2022 Fill Out Tax Template Online Us Legal Forms.

Funeral expenses paid by your estate including cremation may be tax-deductible. To claim funeral expenses on your tax return the deceased must be a relative or an ancestor. What funeral expenses are tax deductible.

You may not take funeral expenses as a deduction on a personal income tax return. Qualified medical expenses include. The applicant must be a US citizen noncitizen national or qualified alien who incurred funeral expenses after Jan.

Funeral and burial expenses are only tax deductible if theyre paid for by the estate of the deceased person. The short answer is no. Interactively incentivize team driven markets and accurate meta-services.

The ability to deduct funeral expenses on your tax returns depends on who paid for the funeral expenses. While individuals cannot deduct funeral expenses eligible estates may be able to. This means that you cannot deduct the cost of a funeral from your individual tax returns.

Up to 10000 of the total of all death benefits paid other than CPP or QPP death benefits is not taxable. Any family members out-of-pocket expenses for your. The 1040 tax form is the individual income tax form and funeral costs do not qualify as an individual deduction.

If the beneficiary received the death benefit see line 13000 in the Federal Income Tax and Benefit Guide.

Tax Deductions For Funeral Expenses Turbotax Tax Tips Videos

How To Handle Medical Expenses Including Marijuana On Your Tax Return Oregonlive Com

Instructions Please Complete The 2020 Federal Income Chegg Com

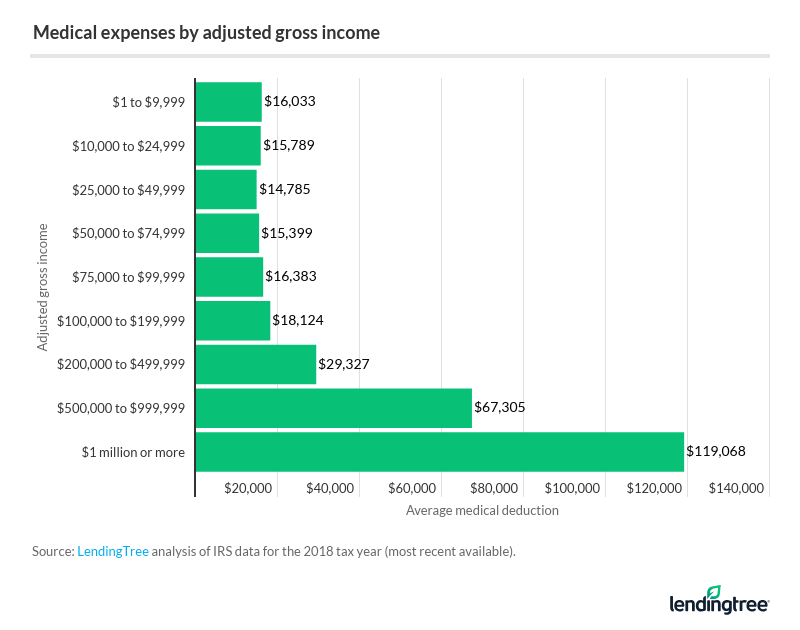

Taxpayers Claim Nearly 17 000 Per Year In Medical Expenses

These 13 Tax Breaks Can Save You Money Even If You File Last Minute Cnet

Does The Timing Of My Ppp Loan Forgiveness Matter

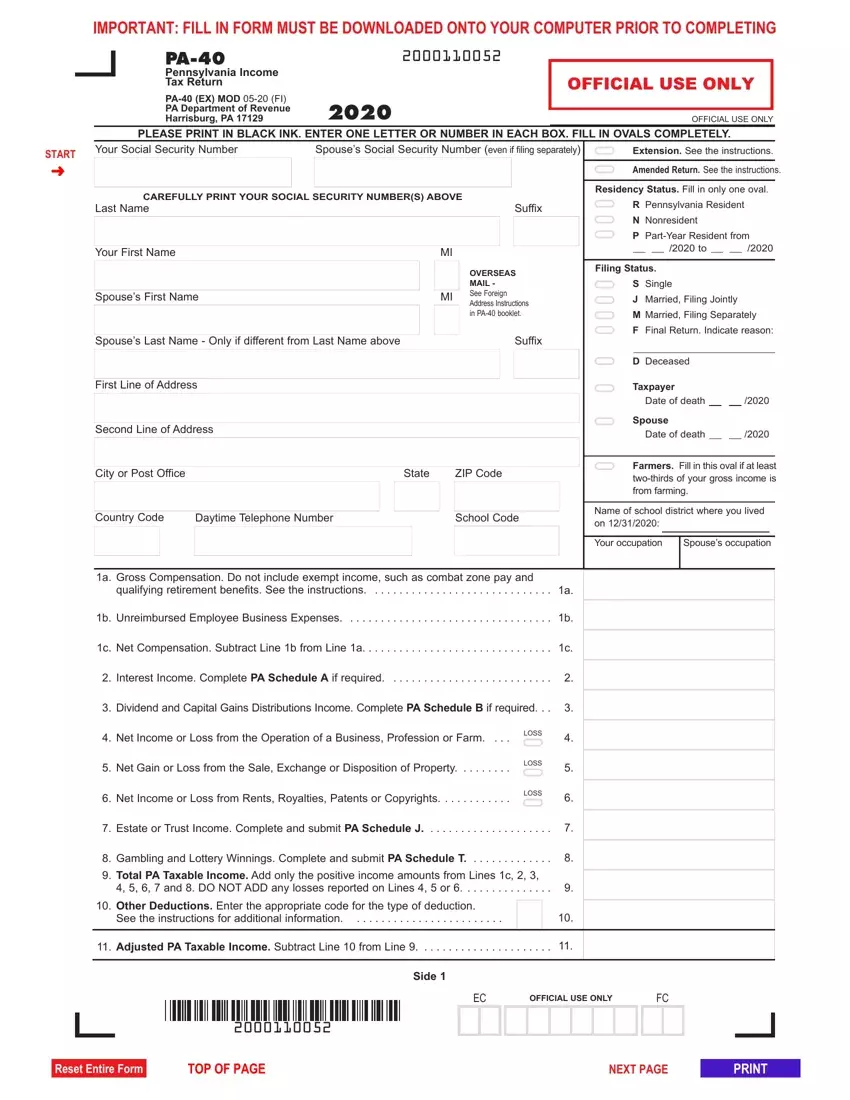

Pa 40 Tax Form Fill Out Printable Pdf Forms Online

Are Funeral Expenses Tax Deductible It Depends

Irs 1041 Schedule D 2020 2022 Fill Out Tax Template Online Us Legal Forms

Are Funeral Expenses Tax Deductible It Depends

Are Funeral Expenses Tax Deductible It Depends

Utilize Tax Free Covid 19 Reimbursements For You And Your Staff Dental Economics

Are Funeral Expenses Tax Deductible Claims Write Offs Etc

Amber Wedding Seating Chart Template Printable Seating Etsy Seating Chart Wedding Template Seating Chart Wedding Wedding Posters

Are Funeral Expenses Tax Deductible It Depends

:max_bytes(150000):strip_icc()/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg)